Why Own Sandstorm

When it comes to the royalty business, few companies have the experience and expertise that Sandstorm does. For nearly two decades, we’ve been building one of the most diversified and highest-growth precious metal royalty portfolios in the industry. Today, our portfolio consists of over 230 royalties on mining projects around the world, with over 40 projects cash-flowing and many more in development. For investors looking for a truly diversified gold portfolio with long-term sustainable cash flows, it’s time to take a closer look at Sandstorm.

Precious Metals Focused

Gold—it’s in our name and remains our focus. Historically, gold has performed well during times of market volatility, making it an effective way to diversify risk and adding stability to an investment portfolio. Sandstorm shareholders know the benefits of investing in precious metals and we’re committed to building an asset base of some of the best precious metal royalties in the world. Today, approximately 70% of revenue comes from precious metals, growing to over 80% by 2028.

Industry Leading Diversification

Any professional Portfolio Manager will tell you that diversification is key to realizing better risk-adjusted returns. Sandstorm has the most diversified precious metal royalty portfolio when compared to our peer group. In fact, based on third-party analysis, only about 40% of our value is concentrated in the top 5 mining assets, and approximately 60% is concentrated in the top 10 assets. This means that if one mine were to temporarily stop cash flowing, the impact would be less on Sandstorm’s portfolio than it would on a less-diversified portfolio.

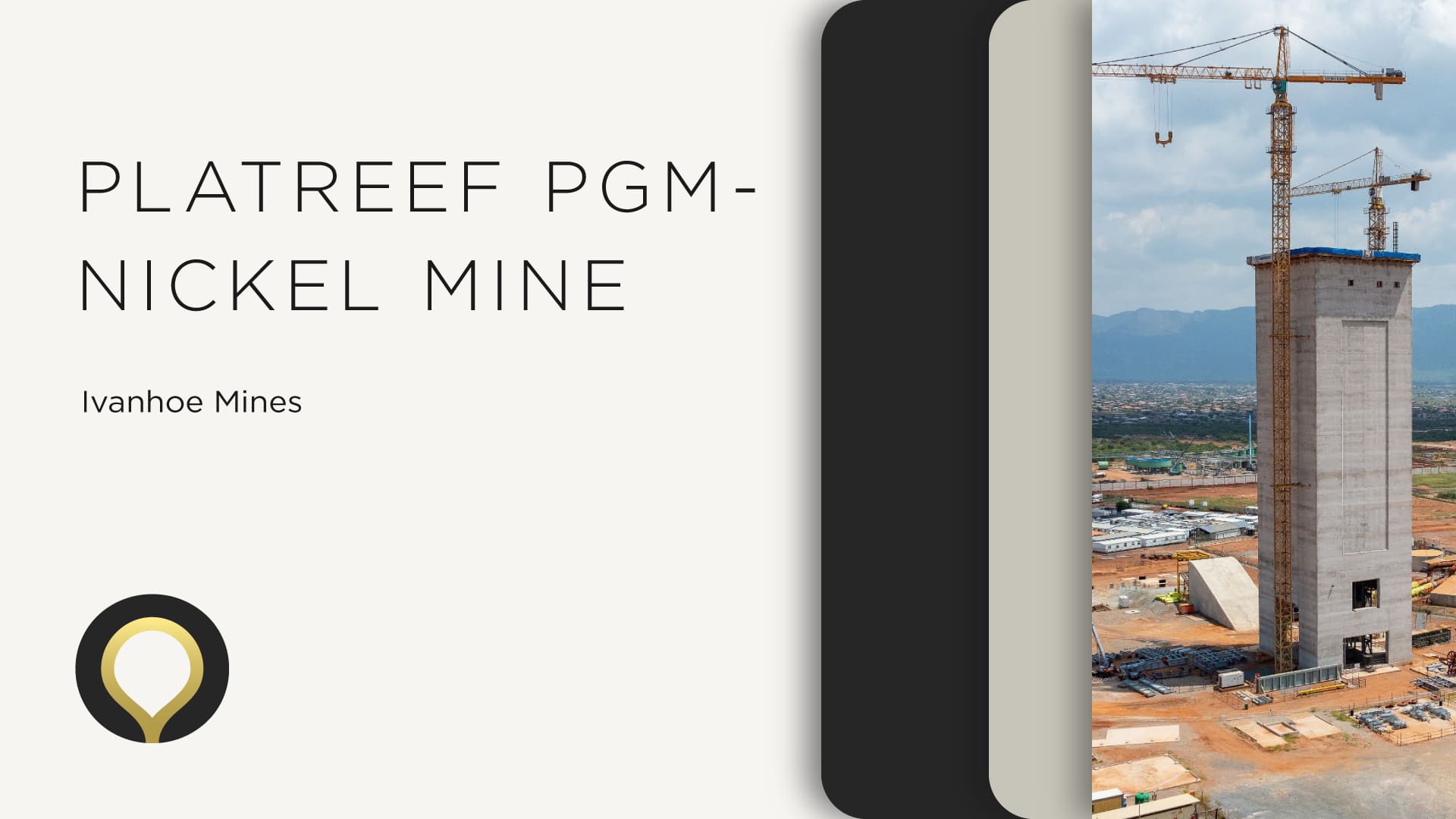

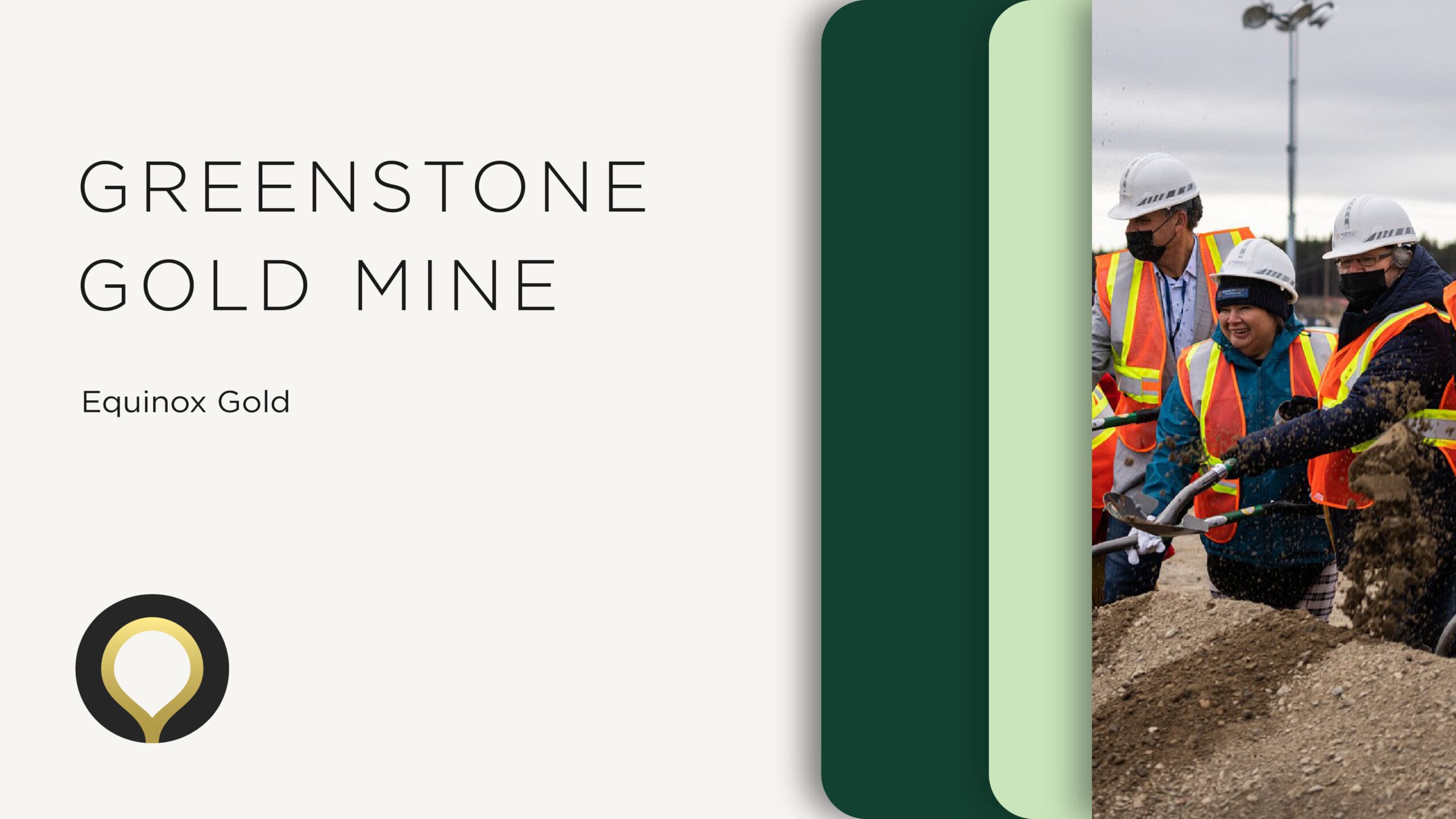

High-Quality, Long-Life Mines

Over the years, Sandstorm has invested in some of the best mining operations in the world. Today, 50% of our top 10 assets operate in the first cost quartile of all mining operations in the world. This means that even in high-inflationary environments, when other mine operators may struggle to be profitable, Sandstorm’s portfolio is comprised of low-cost mines that are more likely to fare better when times get tough.

Growing Cash Flow

Sandstorm has seen impressive growth over the last several years, resulting in new revenue and gold equivalent production records year after year making Sandstorm one of the largest gold royalty companies in the world. We’re continuing to build on this success and are expecting even more growth in the next few years. In fact, Sandstorm’s estimated portfolio cash flow is expected to grow to approximately $250 million in the next several years (including the MARA stream option).

Commodity price assumptions of $2,300/oz Au, $27/oz Ag, $5.00/lb Cu.

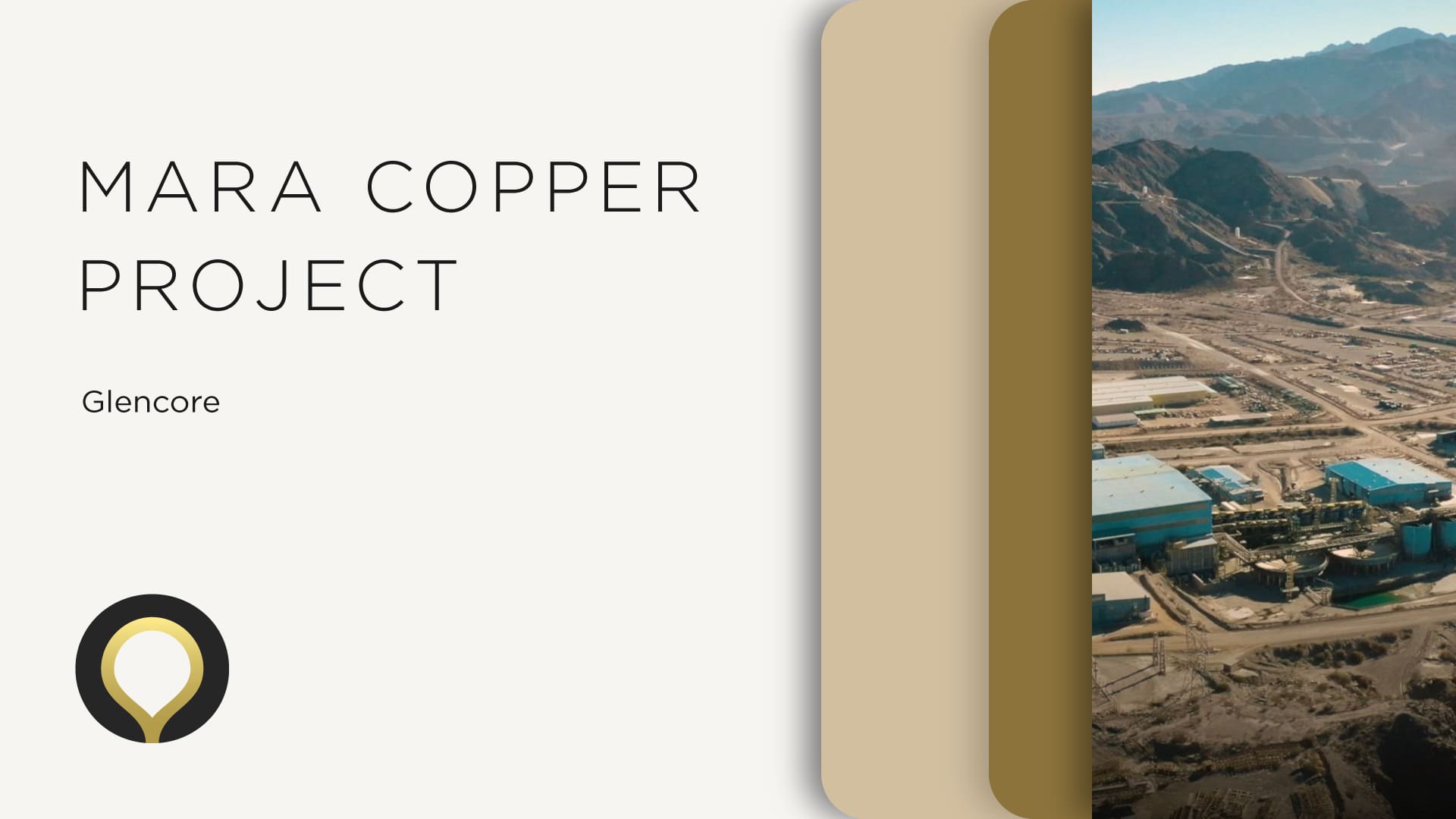

Where there’s copper, there’s gold.

Geologically, precious metals like gold and silver are often discovered alongside large copper deposits. This precious metal by-product creates an ideal partnership opportunity for companies like Sandstorm that can help finance copper operations by pre-purchasing the precious metal by-products in the form of a gold or silver stream.

At Sandstorm, we’ve taken this idea one step further and in 2022 we launched our strategic growth partner: Horizon Copper. Horizon is a premier copper company with interests in three of the largest copper mines in the world. As a growth partner, Sandstorm has the exclusive opportunity to invest alongside Horizon Copper in any future transactions, securing precious metal streams on copper mines. This allows Sandstorm to remain focused on precious metals investments while also helping to facilitate the growth of critical metals like copper, that are integral for the energy transition.

Visit Horizon Copper

The Green Energy Transition Starts Here

Most people don’t think “green” when they think “mining”. But never has mining been more integral to the future success of human society than it is today. The fact is, if the world hopes to achieve its green energy goals, we need to invest in the critical minerals that will build the technology required.

Precious metal royalties are one of the most effective ways to provide financing to critical metal operations. By providing upfront capital to mining companies in exchange for the right to purchase precious metal by-products, Sandstorm is helping facilitate the green energy transition.

Our Approach to Sustainability

Dig Deeper

Use the links below to download and discover more about Sandstorm Gold Royalties. If you have specific questions or would like to talk to someone from the Sandstorm team, please contact us.

Investor Presentation

Download the latest Investor Presentation to learn why Sandstorm is a gold investment that stands out from the rest.

DownloadAsset Handbook

With over 230 royalties acquired since 2009, we offer an exciting investment opportunity in a diverse portfolio of royalty assets. Discover all of Sandstorm’s royalties around the globe.

DownloadAnnual Report

Our 2023 Annual Report includes our annual Financial Statements and Management Discussion & Analysis and a letter from Sandstorm’s President & CEO.

DownloadSustainability Report

Learn more about Sandstorm’s approach to sustainability including our due diligence process, mining partnerships, and employee engagement.

DownloadMore Videos

Follow us on YouTube

Catch up on the latest interviews with Sandstorm management, video announcements, and more.

Watch More VideosQuestions?

Whether you’re new to investing or a long-term shareholder, we’re happy to connect with you and answer any questions. You can contact us directly or browse some Frequently Asked Questions to get you started.

Newsworthy

"*" indicates required fields

Stay Informed

The best way to stay up to date with recent news and events is by joining Sandstorm’s email list.